Massachusetts Estate Tax Calculator 2025. The estate tax rate for massachusetts is graduated. That said, most estates do not have to pay the estate tax because they don’t exceed the minimum threshold.

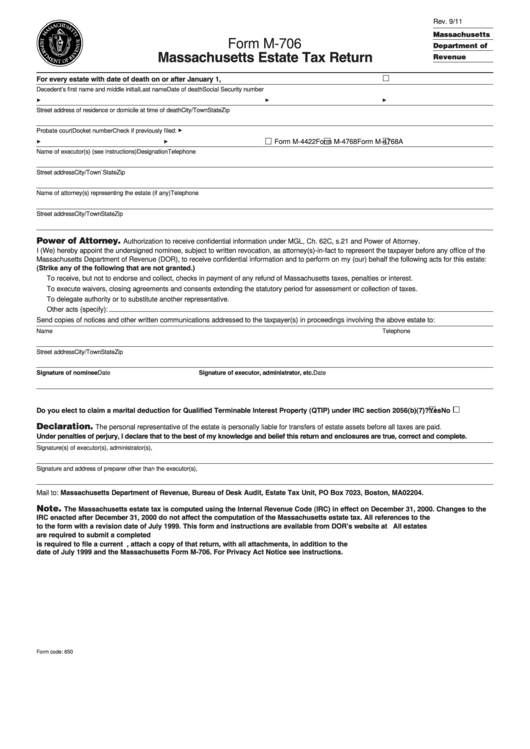

This guide covers how to file and. Significant changes to the massachusetts estate tax, capital gains tax and massachusetts millionaires tax were signed into law by gov.

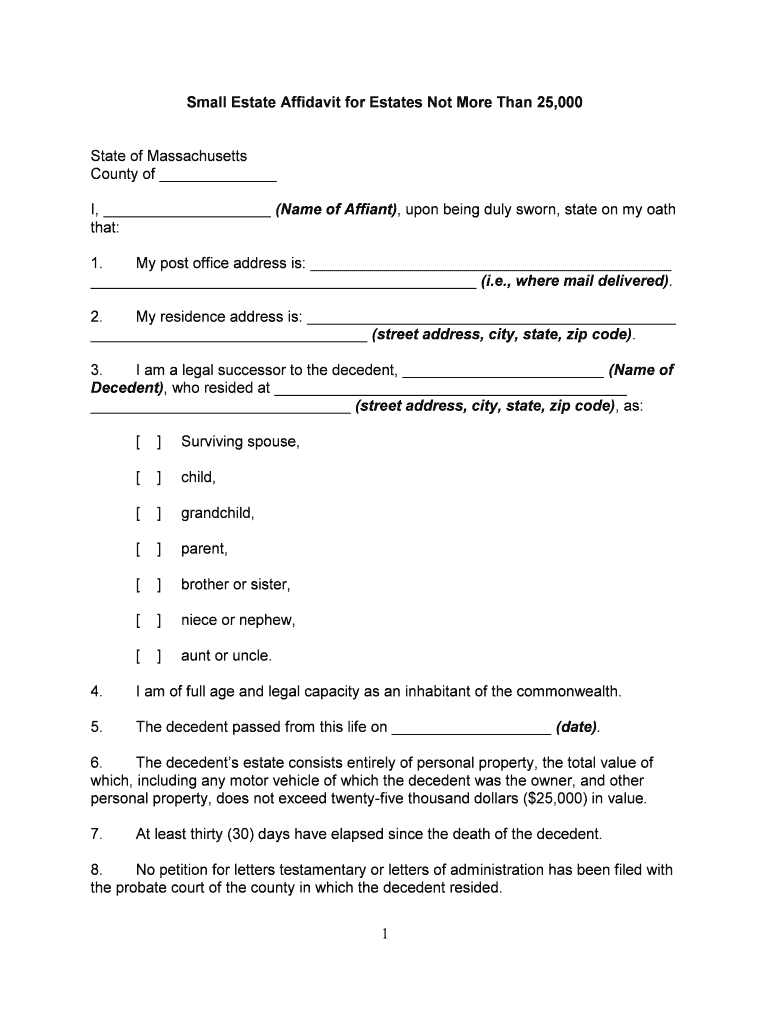

Your Guide to Navigating the Massachusetts State Estate Tax Law, In 2023, all estates valued above. Free estate tax calculator to estimate federal estate tax in the u.s.

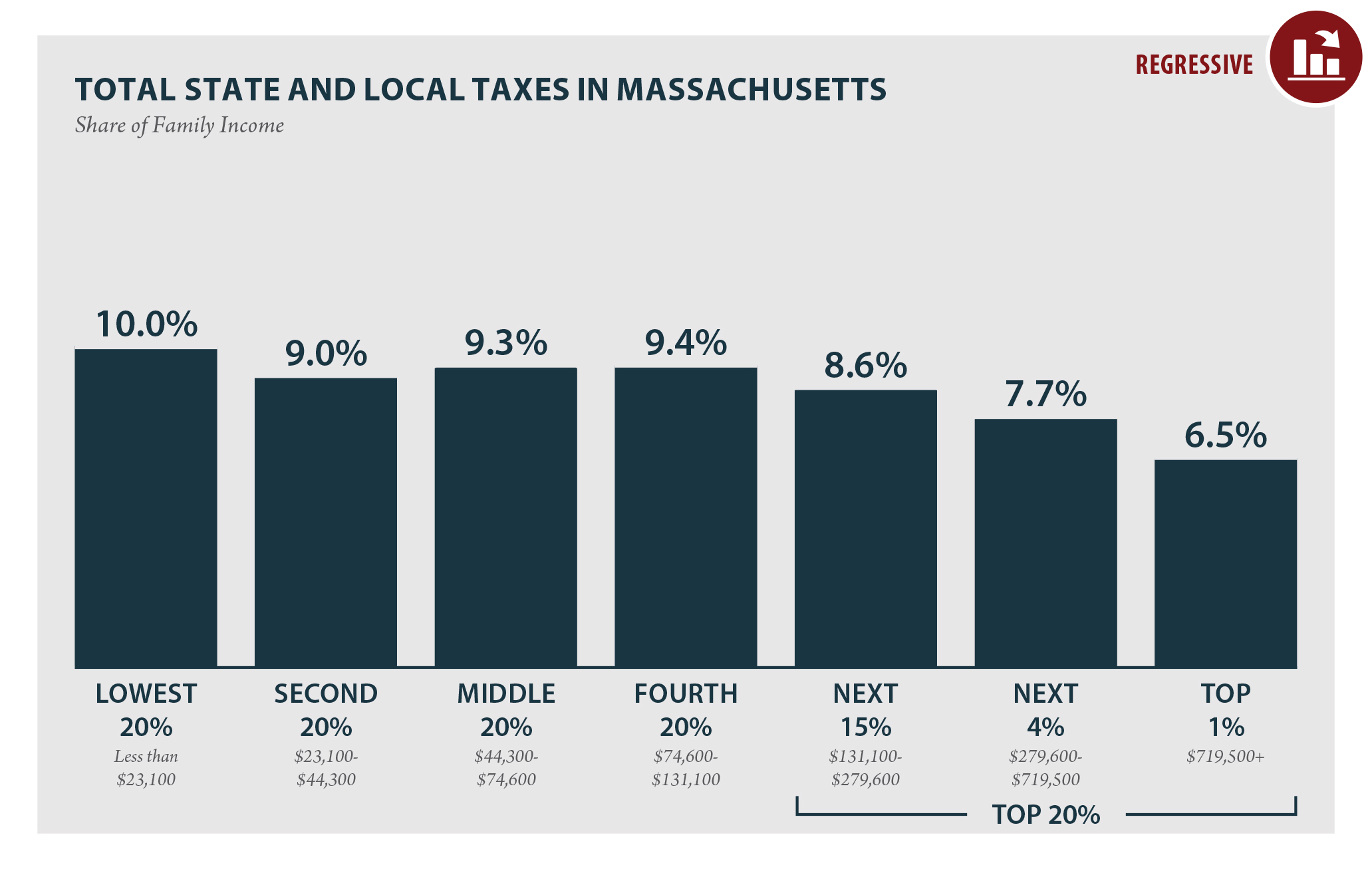

Massachusetts estate tax calculator Fill out & sign online DocHub, The value of the estate over $2 million is subject to tax at rates ranging from 8% to 16% for estates over $10 million. This guide covers how to file and.

Massachusetts Tax Forms Fillable Pdf Printable Forms Free Online, Free estate tax calculator to estimate federal estate tax in the u.s. The value of the estate over $2 million is subject to tax at rates ranging from 8% to 16% for estates over $10 million.

Massachusetts Property Tax Rates 2023 (Town by Town List with, Learn what is involved when filing an estate tax return with the massachusetts department of revenue (dor). The new law amended the estate tax by providing a credit of up to $99,600, thereby eliminating the tax for estates valued at $2 million or less and.

Historical Estate Tax Exemption Amounts And Tax Rates, Use our income tax calculator to find out what your take home pay will be in massachusetts for the tax year. For individuals dying on or after january 1, 2023, the new law increases the estate tax exemption for a massachusetts estate from $1 million to.

Tax rates for the 2025 year of assessment Just One Lap, This guide covers how to file and. For individuals dying on or after january 1, 2023, the new law increases the estate tax exemption for a massachusetts estate from $1 million to.

Massachusetts Property Tax Rates NORTH OF BOSTON LIFESTYLE GUIDE™, Let’s say your total taxable estate is $8 million. If your estate owes estate tax, how much will it actually owe?

Estate Planning 101 Massachusetts Estate Tax Planning YouTube, To figure out how much your. Updated on feb 16 2025.

Massachusetts Estate Tax Rates Table Estate Tax Current Law 2026, An increase to the threshold/exemption amount from $1 million dollars to $2. The massachusetts tax calculator for 2025 encompasses a comprehensive suite of features to cater to your tax calculation needs.

massachusetts estate tax rates table Karoline Mccord, The new law amended the estate tax by providing a credit of up to $99,600, thereby eliminating the tax for estates valued at $2 million or less and. In 2025, the lifetime exemption will be set at $13.61 million.

Fireballs In The Sky 2025. These celestial events provide a tangible. Est (0030 gmt on dec. Spooky season of the…

Mothers Day Brunch Nashville 2025. The mother's day brunch buffet will run saturday, 10 a.m. Gaylord opryland tickets ticket reservation…

Lobsterfest Maine 2025. This annual seafood festival takes place during the first weekend of august, from wednesday through sunday. From…